Riyadh has emerged among the top 15 fastest-growing cities by 2033 on the Savills Growth Hubs Index.

Driven by Vision 2030, Saudi Arabia continues to offer endless opportunities for new development and business expansion. Notably, Riyadh is the only non-Asian city on Savills’ top 15 Growth Hubs list due to its forecast of a 26 percent population growth, taking the city from 5.9 million to 9.2 million in 10 years. Riyadh’s growth will likely result in continued government spending on mega infrastructure projects as well as improved amenities and services to accommodate the growing population.

“Saudi Arabia boasts a population of around 36 million people and, astonishingly, 67 percent are under the age of 35. The employment potential and ultimate spending power of this segment of the population over the next decade are enormous,” stated Richard Paul, Head of Professional Services & Consultancy Middle East.

FDI surges

Earlier this month, government data revealed that the net inflow of foreign direct investment (FDI) in Saudi Arabia increased by 5.6 percent annually to SAR9.5 billion ($2.53 billion) in the first quarter of 2024.

“The 30-year tax relief for regional headquarters, expanding market, and promising prospects are attracting international companies and reinforcing Riyadh’s position as a vital regional hub for leading businesses across diverse industries,” stated Ramzi Darwish, head of Savills in Saudi Arabia.

Darwish added that Riyadh is experiencing a remarkable surge in corporate interest, with over 180 foreign companies establishing their regional headquarters in the city in 2023, surpassing the initial target of 160. “This growing confidence reflects the robust potential of the Saudi capital,” he added.

Asian cities drive growth

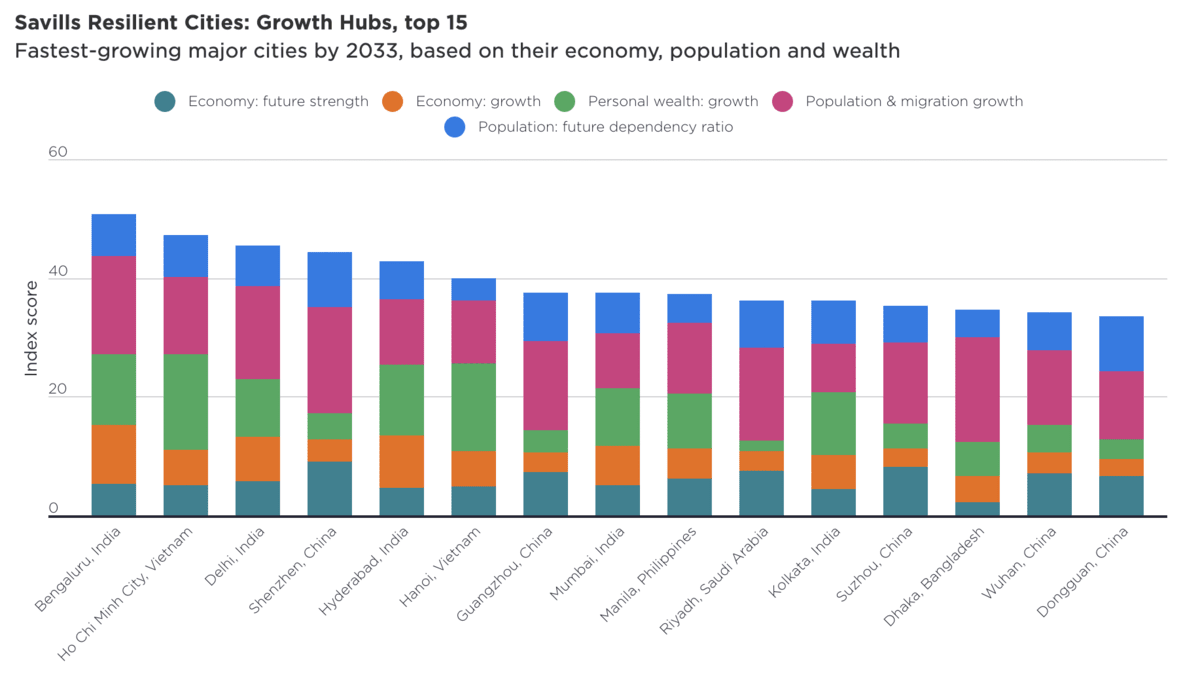

The Savills Growth Hubs Index is a companion of the Resilient Cities Index. Savills specifically examines the economic strength pillars and forecasts them to 2033, to identify high-growth cities with rising wealth and expanding economies.

Indian and Chinese cities take five spots each in the top 15, followed by Vietnam with two, and the Philippines, Bangladesh, and Saudi Arabia with one each.

In economic terms, cities in India and Bangladesh are set to average GDP growth of 68 percent between 2023 and 2033, followed by those in Southeast Asia, including Vietnam and the Philippines, at 60 percent,” stated Paul Tostevin, director and head of Savills World Research.

Read: Saudi Arabia’s non-oil sector continues to grow in June, employment rises: PMI

Real estate implications

As global growth turns from the West to the East, cities like Riyadh will witness multiple real estate implications. The new centers of innovation will become magnets for growing and scaling businesses. This will underpin demand for offices, manufacturing and logistics space, and homes. Meanwhile, rising personal wealth and disposable incomes will drive opportunities for new retail and leisure developments.

The transformation of Asia’s economic base, with its rising emphasis on tech-driven growth, underpins the dominance of the region’s cities in the rankings. However, upcoming infrastructure investment and strategies to improve connectivity and business competitiveness are other key factors.

While economic performance and population growth are promising indicators of future growth, there are other factors that cities need to succeed. Tostevin explains that today’s global growth hubs won’t automatically turn into tomorrow’s resilient cities. Thus, cities need to consider their own pathways to more environmentally sustainable development and improve education and labor force participation. “They’ll also need to facilitate stable, transparent, and liquid real estate markets,” added Tostevin.

For more economy news, click here.