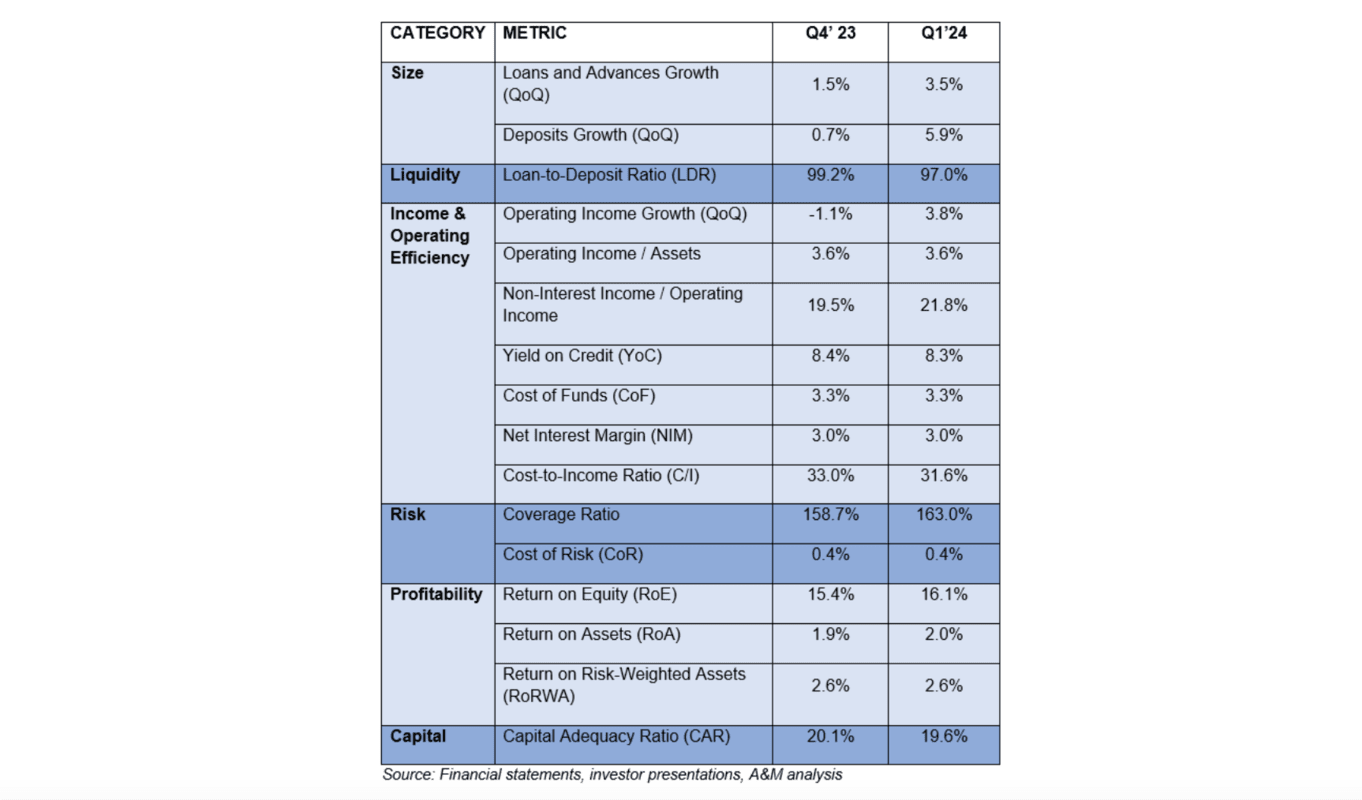

Alvarez & Marsal (A&M), a leading global professional services firm, has released its latest KSA Banking Pulse for Q1 2024. The report shows that deposits of the main Saudi banks grew at a faster pace (+5.9 percent) than loans & advances (L&A) (+3.5 percent) quarter on quarter (QoQ). Consequently, the loans-to-deposit ratio (LDR) retreated by 2.2 percent QoQ on higher deposit growth, to be at 97 percent in Q1’24.

Operating income increased by 3.8 percent QoQ, majorly due to growth in non-core income (+16.2 percent QoQ) with marginal growth in net interest income (NII) (+0.8 percent QoQ). Furthermore, impairment charges (+10.7 percent QoQ) subdued the growth in net income (+6.0 percent QoQ).

Banks reported improved cost efficiency as cost-to-income (C/I) ratio decreased by 1.4 percent QoQ; Overall, return on equity (RoE) increased 0.7 percent QoQ to 16.1 percent while return on assets (ROA) increased marginally by 0.1 percent to 2.0 percent in Q1’24.

Key trends

The report identifies several key prevailing trends for Q1 2024:

1. Combined L&A of the top ten banks increased by 3.5 percent QoQ, faster than the previous quarter (+1.5 percent QoQ). Total deposits increased by 5.9 percent QoQ, with growth in CASA deposits being the highest (+8.2 percent QoQ), driving the aggregate.

2. Operating income increased due to significant growth in non-interest income despite a slow growth in NII. Total operating income increased by 3.8 percent QoQ to SAR34.1 billion in Q1’24, primarily due to a 16.2 percent QoQ growth in non-interest income to SAR7.4 billion, while NII grew only marginally by 0.8 percent QoQ to SAR26.7 billion.

3. Net Interest Margin (NIM) contracted marginally by 6 bps QoQ to 2.96 percent. Seven of the top ten banks in KSA reported a contraction in NIM, as the yield on credit decreased by 7 bps QoQ while the cost of funds remained stable at 3.3 percent in Q1’24. This, coupled with the decrease in LDR by 2.2 percent QoQ, led to the NIM contraction.

4. Cost-to-income ratio (C/I) ratio improved for the first time after four consecutive quarters by 138 bps QoQ to 31.6 percent in Q1’24, due to a fall in operating expense (-0.5 percent QoQ) and a rise in operating income (+3.8 percent QoQ). Majority of the KSA banks reported improved cost efficiency in Q1’24.

5. Cost of risk (CoR) deteriorated marginally due to higher impairment charges for the quarter, weakening by 3 bps QoQ to settle at 0.4 percent in Q1’24. Half of the top ten banks reported a deterioration in CoR.

6. Eight out of the top ten banks witnessed improved profitability, with higher operating income and improved cost efficiency resulting in ROE expansion. Aggregate net income of KSA banks increased by 6.0 percent QoQ to SAR18.7 billion in Q1’24 despite the slow growth in NII (+0.8 percent QoQ), driven by a substantial growth in non-core income (+16.2 percent QoQ) and decreased operational expenses (-0.5 percent QoQ).

10 largest listed banks in the Kingdom

A&M’s KSA Banking Pulse examines data of the 10 largest listed banks in the Kingdom, comparing the Q1 2024 results against Q4 2023 results. The report assesses the banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability, and capital, using independently sourced published market data and 16 different metrics.

The 10 largest listed banks analyzed in A&M’s KSA Banking Pulse are Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank (RIBL), Saudi British Bank (SABB), Banque Saudi Fransi (BSF), Arab National Bank (ANB), Alinma Bank, Bank Albilad (BALB), Saudi Investment Bank (SIB), and Bank Aljazira (BJAZ).

Continued focus on cost control throughout 2024

Mr. Asad Ahmed, managing director and head of Middle East financial services at A&M commented: “The positive tone on Q1 2024 performance follows a strong 2023 for bank profits. Profitability ratios for the current fiscal improved as bank’s fees and non-interest income contributed to the growth.”

“While SAMA continues to follow US fed with respect to the benchmark interest rates, we expect higher interest rates will constrain mortgage lending growth in FY’24. A downward rate adjustment is being predicted in the second half though both the timing and the size of the cuts have gone though many predictive revisions; nevertheless, lower rates are likely to gradually affect margins; banks will need to increase their focus on fee and transactional banking income. We also can expect a continued focus on costs throughout 2024,” Ahmed added.

For more news on banking & finance, click here.