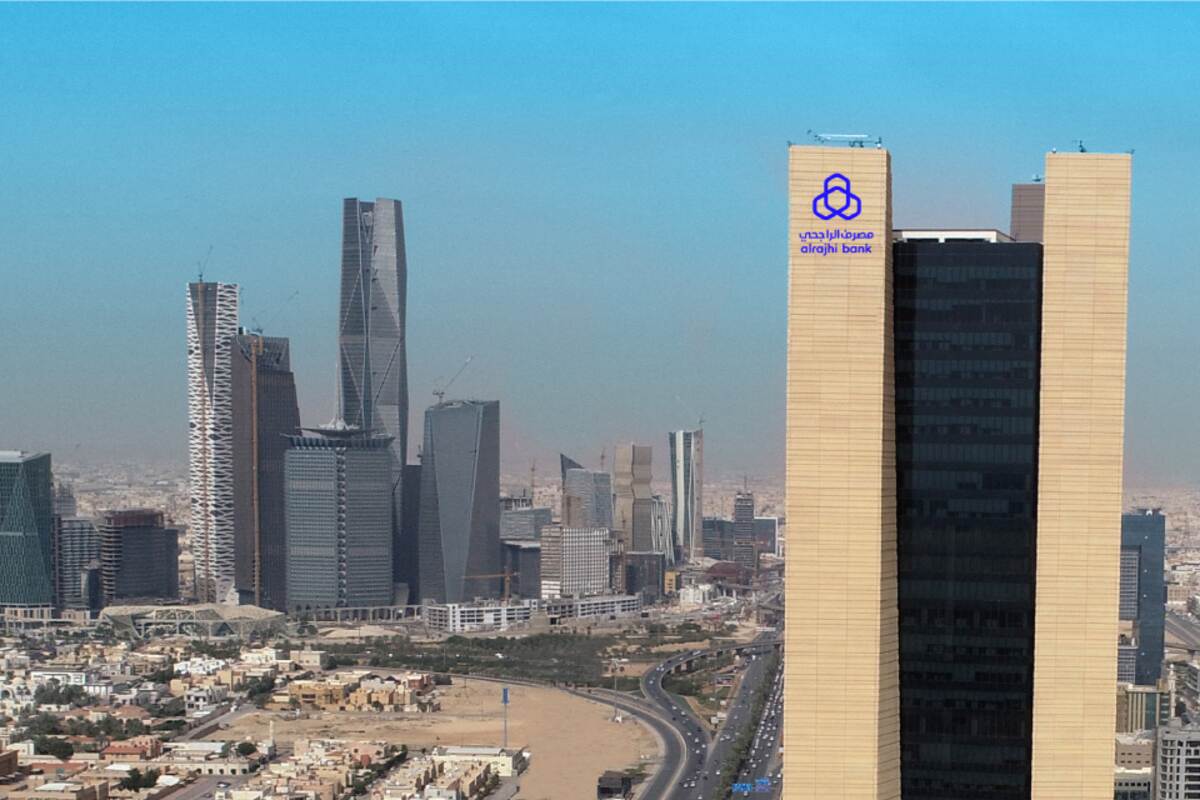

Al Rajhi Bank, one of the 10 largest listed banks Saudi Arabia, has announced its interim financial results for the period ending September 30, 2024. The bank demonstrated a 19 percent year-on-year (YoY) increase in net profit, which reached SAR19.72 billion ($5.25 billion). This growth was primarily driven by a significant rise in net financing and investment income.

Additionally, the bank has shown significant growth in multiple financial metrics, highlighting its strong operational performance and strategic efforts.

The earnings surpassed analysts’ average estimate of SAR18.68 billion, according to LSEG data.

Total operating income for the bank reached SAR32 billion, reflecting a 16 percent increase. This growth was fueled by a 17 percent rise in the financing portfolio and a remarkable 31 percent increase in the investment portfolio.

The total provisions for expected credit losses saw a substantial increase of 41 percent, amounting to SAR2.1 billion.

The lender’s total assets rose by 20 percent YoY, reaching SAR944 billion. The loans and advances portfolio increased by 16.7 percent to SAR693 billion, while client deposits grew by 9.6 percent to SAR628 billion.

Earnings per share improved to SAR4.67 compared to SAR3.95 in the same period last year.

Al Rajhi Bank’s financial results for 2024 highlight its strong performance and resilience in the banking sector, driven by significant growth in financing and investment income.

For more news on banking & finance, click here.