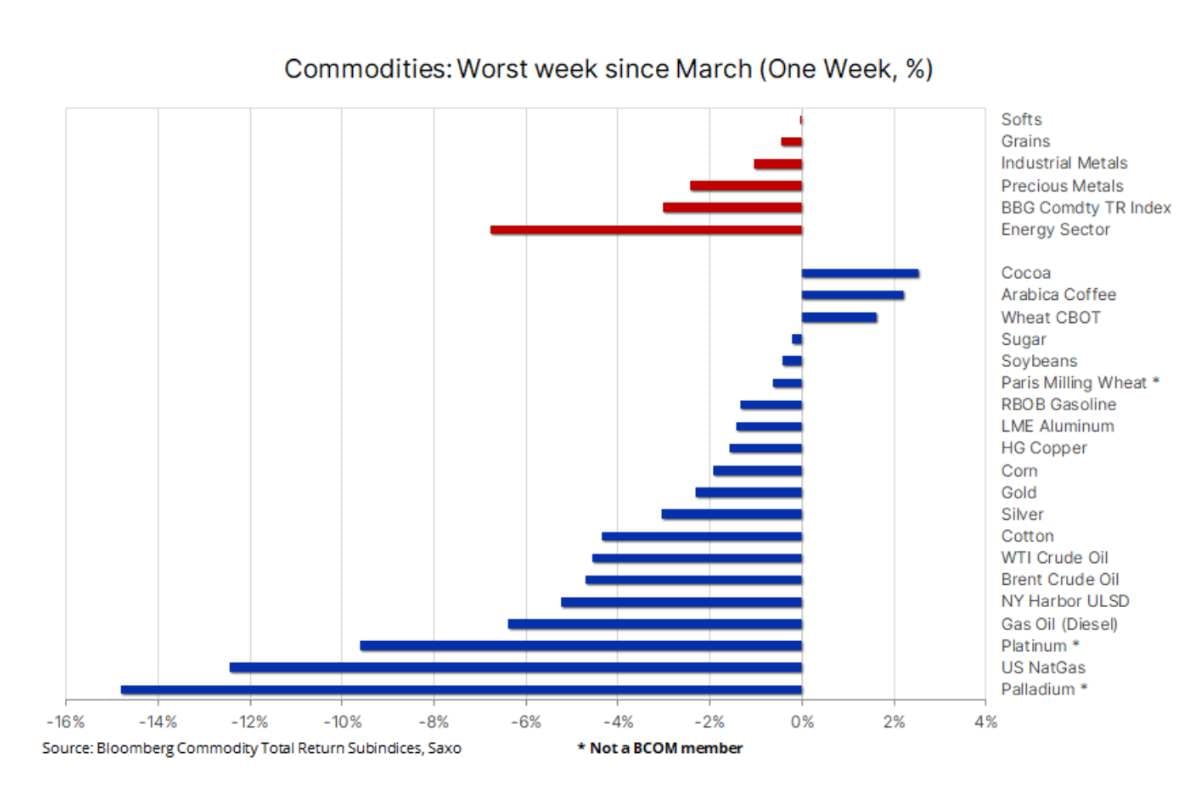

The commodities market is facing its most substantial weekly decline since March. According to a Saxo Bank MENA report, this comes after various sectors saw widespread selling the previous week.

Commodities market performance

The softs sector, mainly driven by cocoa and coffee’s robust performance, is resisting the decline despite a worsening supply outlook. On the other hand, the energy sector is likely to get the most impact with wrong-footed long positions exiting, primarily due to concerns over weakened demand. While the sector saw a gradual improvement in June and September, reports of deteriorating business conditions in the United States, Europe, and China in October reversed it.

Meanwhile, the metal sector has a mixed performance. Gold’s price correction is losing momentum. Meanwhile, silver, platinum and palladium face pressure amid economic uncertainties.

Looking at the grains sector, there’s also a decline after the US Department of Agriculture predicted record-high corn production and elevated global stocks of soybeans and wheat. With a potential supply in surplus, the sector is seeing lower trading activity.

On the macroeconomic front, the US dollar strengthened against peers, notably the Australian dollar, Japanese yen, and British pound. Additionally, US bond yields rose following Federal Reserve Chair Jerome Powell’s hawkish sentiment at an International Monetary Fund conference. He emphasized making careful moves but not hesitating to tighten policy to contain inflation.

The Bloomberg Commodity Index, tracking major futures, is on track for a 3 percent weekly loss. This is led by a 7 percent drop in energy and a 2.4 percent decline in precious metals.

Short vs. long term

While Saxo Bank reported a short-term weakness, it remains optimistic in the long run.

“Despite the current price softness, driven by economic growth concerns in China, Europe and potentially also the US, Saxo holds the view that key commodities are at the beginning of a multi-year bull market driven by CapEx drought due to rising funding costs, lower investment appetite and lending restrictions,” remarked Ole Hansen in the report. He is the head of commodity strategy at Saxo Bank.

In recent periods, the sustainability movement has also been diving demand for industrial metals, specifically those utilized for emerging energy technologies. This “greenflation” however comes at a challenging time for miners. These professionals are grappling with increased costs, lower ore quality and heightened social and environmental scrutiny.

Apart from this, Saxo Bank underscored increased fragmentation and its impact in bolstering key commodities’ demand and prices. In the agricultural sector, the bank foresees greater volatility in weather patterns, potentially leading to price spikes.

Hansen added, “Overall, these supply and demand imbalances may take years to correct, ending up supporting structural inflation above 3 percent, which will likely increase investment demand for tangible assets such as commodities.”

Positive YoY gross roll yield returns

The commodities market report also noted that since late 2021, the scarcity of key commodities has yielded positive year-on-year (YoY) gross roll yield returns on the Bloomberg Commodity index.

Saxo Bank defines this metric as “the difference between the performance of spot and total return.” The spot price is the current market price of a commodity for immediate delivery. Meanwhile, the total return index is the actual realized return on an investment. It includes additional elements such as funding costs, expenses related to storage and the positive return from rolling futures contracts.

Over the last decade, the average return from rolling futures contracts has been negative 3.25 percent. This indicates a prolonged period of abundant supply until the disruptions caused by the 2020 pandemic, which led to a surge in demand for consumer goods. Last December, there was a peak in returns, reaching 9.25 percent. However, it has since decreased to the current 4.5 percent.

“We believe positive roll yields caused by this tightness will continue to underpin investment demand for the sector in the months and quarters to come,” shared Hansen.

A deeper look at the metal sector

Gold has undergone consolidation after reaching a peak of $2,009 in October. This is fueled by various factors including US fiscal policy concerns. Following a dovish Federal Open Market Committee meeting earlier this month, traders were also able to book profits.

Despite correcting lower around $60, Saxo Bank noted that the bullish setup remains intact.

“We maintain the view that the Fed is done hiking rates and that rate cuts from around the middle of next year, together with record demand from central banks, will continue to support a move towards a fresh record high next year,” added Hansen.

Read: Gold prices on a strong start as Moody’s lowers US credit rating

On the contrary, as stated, the silver and platinum markets are under pressure due to lower growth outlooks. This is paired with rising financing costs in the green transformation industry. Similarly, the palladium market is also struggling. In particular, it dropped to a five-year low due to speculative selling.

A challenged energy sector

Bearing the most brunt in the commodities market, the energy sector is on track for its most significant weekly decline since March.

According to Saxo Bank, the main cause of these losses is the substantial drop in the value of the natural gas contract, which is known for its extreme volatility. This decline exceeds 10 percent for the week, primarily due to lower demand for heating (November typically offers warmer temperatures) amid nearly all-time-high energy production.

Meanwhile, the decline in crude oil and fuel products gained momentum in the recent week, causing Brent to briefly dip below $80, a level not seen since mid-year. Simultaneously, West Texas Intermediate (WTI) experienced a drop under $75 before stabilizing.

A shift in market focus towards a sluggish demand outlook is fueling rising selling pressure. This weakened prospects on demand are influenced by weakening economic conditions in Europe, the US and China, the world’s leading oil importer.

“During this time, the gross short slumped to a 12-year low leaving no positions left to absorb a correction like the one we have seen during the past couple of weeks, hence the risk of crude prices falling to low levels that are not justified by current fundamentals,” elaborated Hansen.

For more economic news, click here.