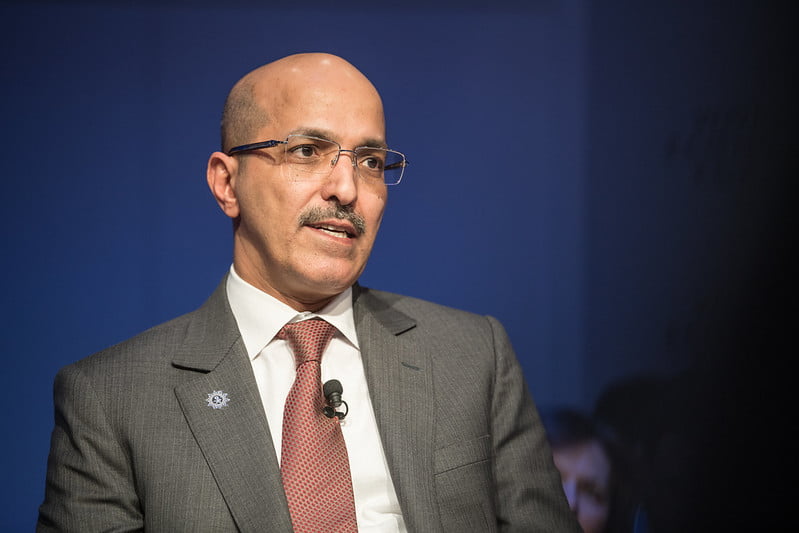

On the sidelines of the World Economic Forum (WEF) in Davos, Saudi Finance Minister Mohammed Al-Jadaan announced that Saudi’s fiscal sustainability policy will ensure that “reserves do not fall below a certain percentage level of the country’s GDP.” He noted that Saudi will “ultimately” consider cutting the rate of value-added tax (VAT) but at the moment it’s still trying to make up for the shortfall in reserves.

Saudi, whose economy is estimated at $1 trillion, said in its budget for 2022 that the Fiscal Sustainability Program aims to decouple the economy from oil price fluctuations, realizing several economic benefits for the non-oil economy and the private sector.

“We are at the final stages of designing our fiscal sustainability policy which aims to achieve fiscal balance,” Jadaan told Reuters.

“He pointed out that according to that policy, Saudi’s reserves “shall not fall below a certain percentage level of GDP. That figure would be in the double digits.”

“In the last five years, we have spent a trillion riyal from reserves and we are still replenishing them,” he said.

Jadaan explained that excess money can go toward the Public Investment Fund (PIF), the country’s $600 billion sovereign wealth fund, and the National Development Fund (NDF).

Foreign reserves shrank from a record high of $737 billion in August 2014 to $529 billion at the end of 2016 amid the fall in oil prices.

Saudi central bank (SAMA)’s net foreign assets stood at 1.63 trillion riyals ($434.57 billion) at the end of March.

Value-added tax (VAT)

Saudi will “ultimately” consider cutting the rate of value-added tax (VAT), which was increased to 15 percent in 2020, said Al-Jadaan.

The VAT rate was tripled then to shore up finances hit by low oil prices, as the pandemic hit global demand.

“We will ultimately consider cutting the VAT but at the moment we are still replenishing the reserves,” he said.

Al-Jadaan’s statements come in light of the surplus Saudi’s budget achieved in Q1 2022, the highest in 6 years.

Linkage with Euroclear

During a WEF session, Al-Jadaan announced that a linkage was established with Euroclear, the provider of post-trade services in the Saudi Stock Exchange through the Securities Depository Center Company (Edaa).

Al-Jadaan indicated that this linkage displays the trend toward achieving the goals of Saudi Vision 2030, which seeks to support the development of the financial sector by endeavoring to expand the investor base to meet Saudi local debt financing requirements and to achieve the objectives of the Financial Sector Development Program Strategy in supporting the secondary market development by increasing the liquidity of local government debt instruments through the attraction of more foreign capital.

The linkage is intended to enable international investors to settle domestically issued debt instruments through direct nominee accounts in Edaa using their current accounts in Euroclear and to achieve greater interoperability within the market.

Al-Jadaan said, “In Q1 2023, Saudi will use this year’s expected surplus, as it will have the largest positive impact on the economy, including the NDF, which supports private sector investments.”